Yes, NOTICENINJA is corporate tax notice compliance software that automates key workflows including notice assignments. The platform employs a rule-based system that can manage multiple level rules and ensure notices are directed to the appropriate stakeholder. As a result, you’ll never have to worry about notices being misdirected or slipping between the cracks.

Amended Returns Workflow

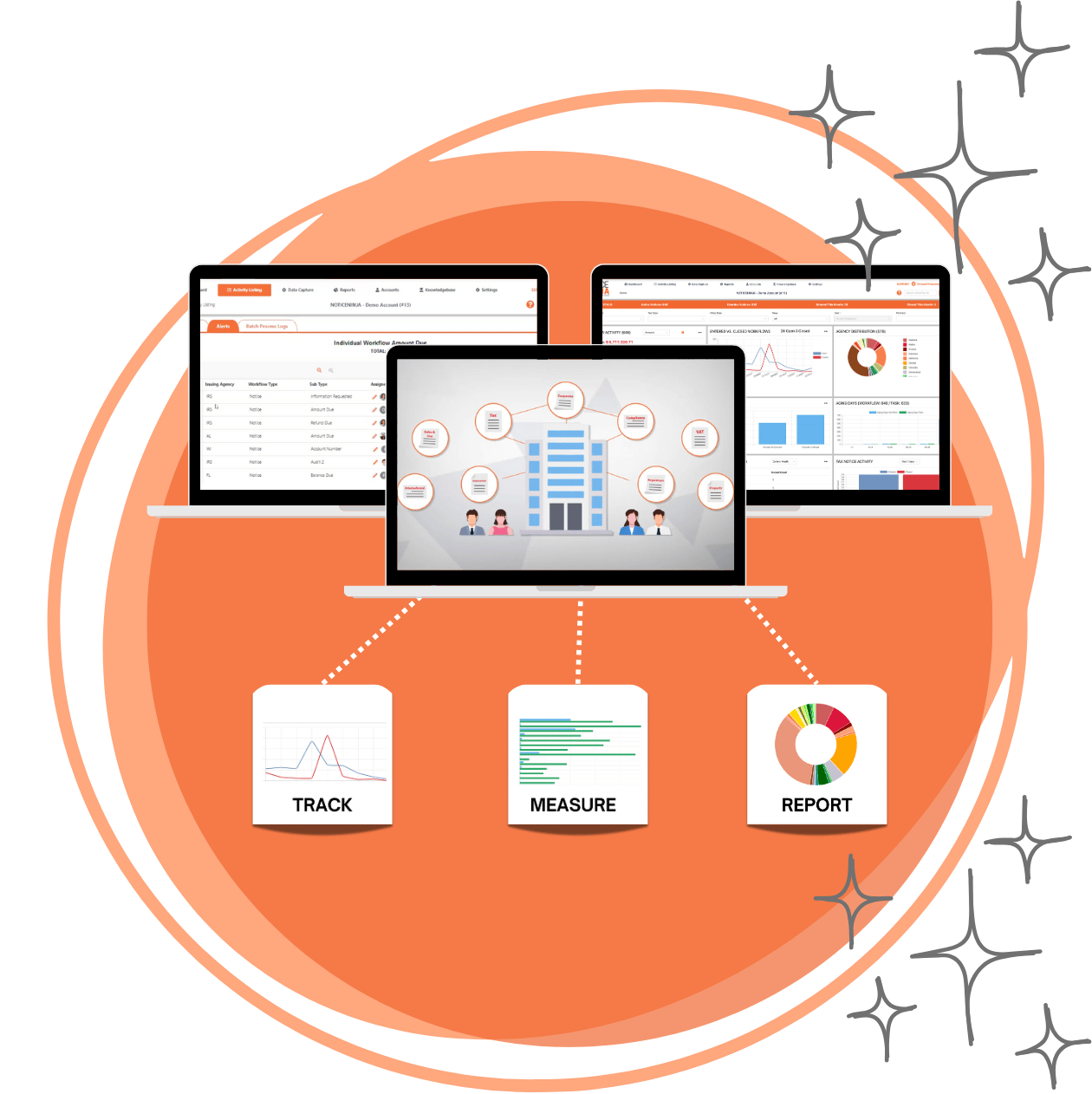

Structure the work. Capture the value. Stay compliant.From Cleanup to Financial Control

Amended returns are no longer just an administrative fix. Leading tax teams use structured workflows to manage corrections with clarity, assign tasks efficiently, and track the effort involved. NOTICENINJA transforms this once-manual process into a high-visibility operation that supports billing, audit readiness, and risk reduction.

What the Amended Returns Workflow Solves

Amended returns affect multiple layers of the tax function: historical filings, employee records, prior-period adjustments, and agency reporting. Without structure, corrections are rushed, undocumented, and often unbilled. This results in missed deadlines, financial exposure, and internal confusion around ownership and effort.

NOTICENINJA eliminates those gaps with standardized intake, subtype-based tasking, and full case visibility. You can scope the resolution, document who is responsible, and capture the true value of every amendment—internally or on behalf of clients.

Smart Intake with OCR & AI

NOTICENINJA uses Optical Character Recognition (OCR) and artificial intelligence to scan incoming amendments and extract fields like jurisdiction, tax period, and filing type. This removes the need for manual entry and speeds up case creation.

Subtype-Based Routing

Every case is routed according to its amendment type—such as W-2C, 1095-C, refund-related, or state-level adjustment—ensuring the right workflow logic and task owner are applied.

Lifecycle Visibility

The full resolution process is managed inside the platform. Approvals, attachments, conversations, and timelines are recorded and accessible in one secure location. Version control and SLA tracking are built in.

Client Approval & Billing Transparency

Corporate tax departments and PE teams gain visibility into amended return activity, which supports internal compliance, cost tracking, and performance review. PEOs, service providers, and CPA firms receive client-facing approval summaries that define scope, estimate effort, and clarify responsibility before work begins, making every resolution measurable and billable.

Core Capabilities of NOTICENINJA

- Intake automation using Optical Character Recognition (OCR) and AI

- Subtype-based routing for accurate workflow logic

- Version tracking with audit-ready history

- Billing and approval documentation for clients or internal stakeholders

- SLA tracking and ownership assignment throughout the case lifecycle

- Secure document management and task collaboration

Platform Impact

Reduce amendment turnaround time by up to 70%

Eliminate spreadsheet tracking and disconnected handoffs

Improve audit readiness with complete version history

Increase billing transparency and recover untracked labor

Gain visibility into agency deadlines and workload distribution

See the Amended Returns Workflow in Action

Schedule a call to see how NOTICENINJA structures, automates, and tracks amended return workflows with complete control and compliance.