How Global Tax Competitiveness Drives U.S. Tax Notice Volume

Global tax policy continues to shift rapidly, and multinational corporations are adapting by restructuring operations, moving...

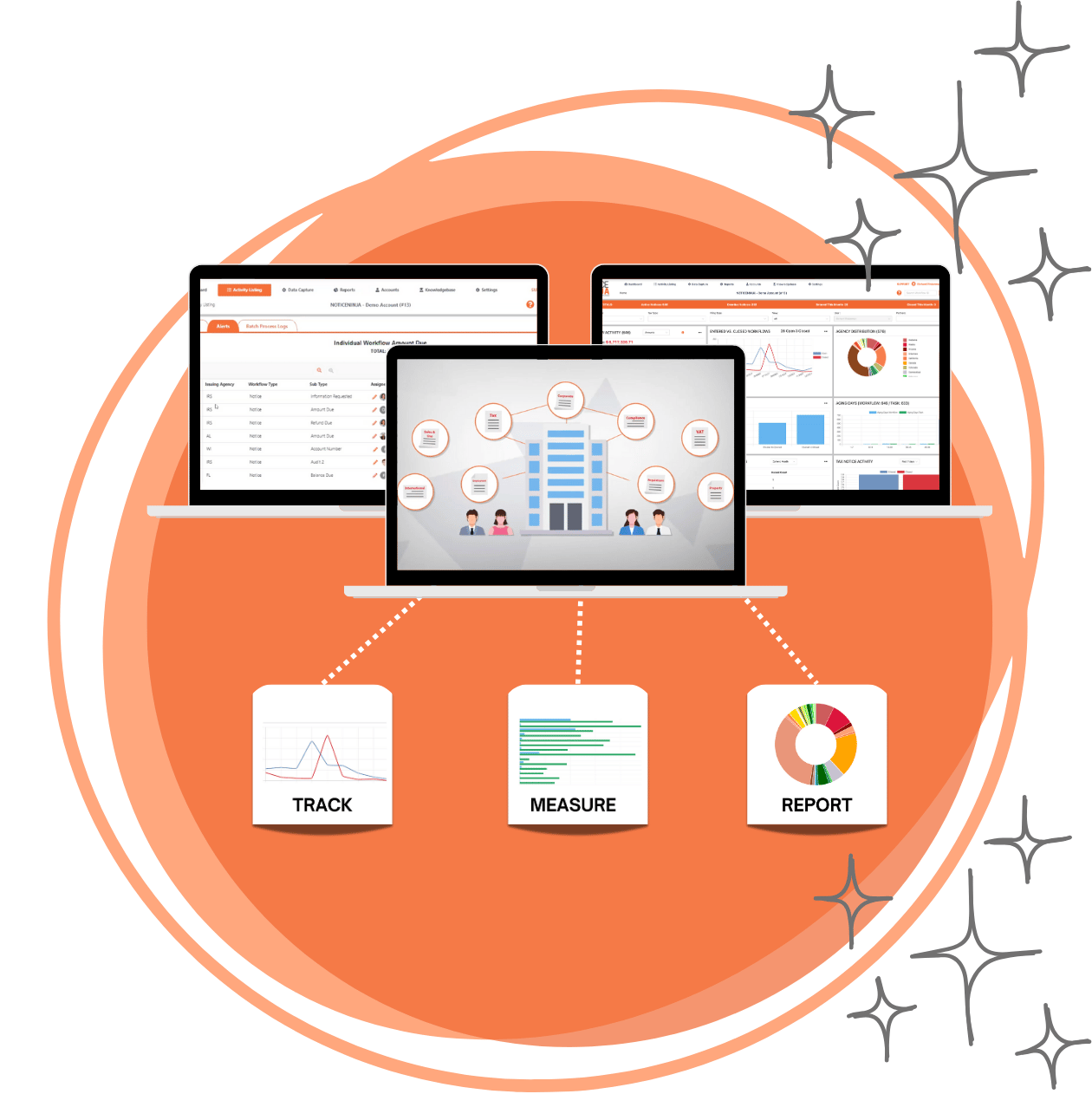

Efficiently track, manage and resolve tax notices.

-1.png)

NOTICENINJA helps teams stay in control to prevent errors and avaoid interest penalties.

NOTICENINJA uses AI to capture key entity data from tax notices, creating a real-time view of parent and subsidiary relationships.

Automatically captures FEINs, EINs, and agency IDs from tax notices

Builds a real-time view of parent and subsidiary relationships

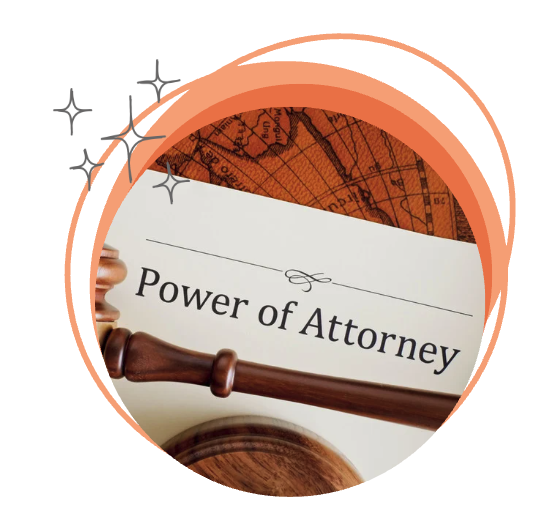

Centralize POAs and authorizations, making it easy to generate, track, and maintain compliance across all entities.

Resolve tax notices within 30 days to avoid penalties and sequential notices with NOTICENINJA cloud-based, SOC 2 compliant software

NOTICENINJA uses proprietary optical character recognition (OCR), machine learning and workflow automation to make the data on scanned notices actionable.

Your data is housed on a centralized platform, so you never need to hunt down information on a spreadsheet or dig through email threads to track tax compliance progress.

NOTICENINJA offers open endpoint API, which enables integration with your current systems to automate data flow, reduce manual work, and streamline notice processing.

.png?width=391&height=115&name=logo_2_3_1%20(1).png)

.png?width=2000&height=645&name=EP_Logo%20(1).png)

Large Service Provider

Professional Employer Organization

Commercial Bank

Global tax policy continues to shift rapidly, and multinational corporations are adapting by restructuring operations, moving...

The 2025 Data Review Report from Notice Ninja is a strategic asset for tax operations teams navigating a more complex,...

For many corporate tax and compliance teams, this season is not just year‑end and quarter‑end. It is the peak of tax notice...

When an audit notice arrives, the request usually sounds straightforward: “Please provide the supporting documentation, original...

Tax teams are not just dealing with more notices. They are dealing with a changing agency environment that is reshaping how...

Imagine standing in the center of a vast airport control tower. Below, hundreds of planes from different countries—each carrying...

In tax operations, much of the focus is on the front end, determining withholding, generating returns, and e-filing across...

A December to Remember for Tax and Compliance Teams December is here and it brings a unique dual perspective. It prompts us to...

For years, tax teams have treated the act of receiving and logging notices — the “mailroom moment” — as a small, administrative...

Why Manual Processes Are Holding Tax Teams Back Manual tax notice management is like running a relay race in flip-flops — you...

When tax notices arrive, they don’t ask which department they belong to. They just show up, by mail, email, fax, or vendor...

Those “new disclosure rules” are ASU 2023-09, FASB’s 2023 update to ASC 740, which requires more granular, transparent income tax...

Managing tax notices without automation is like trying to bail water from a sinking ship with a teaspoon. Every scoop feels like...

Why This Problem Gets Ignored Until It’s Too Late Across enterprise organizations, tax leaders keep running into the same...

Many corporate tax teams handle large filings, multi-state returns, hundreds of entities and multiple agency relationships. But...

Companies that handle overseas operations face complex tax procedures that require a comprehensive approach. These organizations...

Why AI Is Reshaping Corporate Tax Imagine your tax team as a starship crew charting unexplored sectors. Adopting AI is like...

Before any workflow is triggered, before any response is automated, it all begins with one crucial step: turning raw documents...

The 2025 federal government shutdown has interrupted operations at pivotal agencies, including the Internal Revenue Service...

We Believe Configurability Should Be a Baseline, Not a Bonus In today’s tax landscape, where jurisdictions stretch from local...

Why technical tax teams should take a hard look at their notice resolution process before it becomes a financial horror show.

The U.S. Corporation Income Tax Return, Form 1120 isn’t just another filing requirement. For corporate tax teams, especially...

For most corporate tax departments, October 15 feels like the finish line.

You’d think that in 2025, with all the technology, enterprise platforms, and digital filings available, corporate tax departments...

Hidden Risks That Stall Exits and Disrupt Cash Flow

The Hidden Risk Lurking Behind Extension Season

For most corporate tax departments, September feels like a brief exhale. The pressure of mid-year filings has passed, and the...

Exits Are Back on the Table—But Are You Ready?

When most firms talk about growth, they picture soaring revenue, new markets, and celebratory earnings calls. But beneath the...

For years, State and Local Tax (SALT) compliance was managed as a local problem: deadlines tracked on spreadsheets, notices...

Why Refund Offset Audits Are a Challenge

Private equity firms operate in a dual reality. On one side, they navigate high-stakes investment strategies, capital events, and...

Rising Costs, Rising Risks Asset managers are facing a reality check. As AUM grows and private markets expand, the number of tax...

Finance and accounting departments are poised for a revolution, with large % of CFOs planning to increase their investment in...

Yes, NOTICENINJA is corporate tax notice compliance software that automates key workflows including notice assignments. The platform employs a rule-based system that can manage multiple level rules and ensure notices are directed to the appropriate stakeholder. As a result, you’ll never have to worry about notices being misdirected or slipping between the cracks.

Yes, NOTICENINJA’s dashboards and advanced reporting capabilities will give you a bird’s eye view of the tax notices your organization receives – and deep insight into liabilities and opportunities. With NOTICENINJA’s tax notice management and resolution software, you can accurately assess where notices are coming from and how much time and money you expend per jurisdiction. That insight will allow you to get to the root cause of your tax compliance challenges, so you can reduce notice volume and better manage workloads.

Yes, we do.

Backlogs are common and can create a vicious cycle. When organizations have a backlog of notices to respond to – and lack the manpower to tackle them – it’s easy for notices to fall by the wayside. When notices aren’t addressed promptly, issuing agencies will send duplicate or sequential notices, which exacerbates the existing backlog.

If your organization is struggling, NOTICENINJA can help close out your backlog of notices – and empower you to remain backlog-free. The platform’s automated workflows and due date tracking and document management functionalities enable organizations to resolve notices within 30 days, eliminating the cycle of follow-up notices and growing backlogs.

Yes, NOTICENINJA’s tax resolution software has a module that allows you to track and manage all agency contacts and other related information. Within the module, you can view contacts’ addresses, links and login information, which eases traditional change management challenges. Users can also include notes about specific jurisdictions and contacts to streamline notice resolution.